nanny tax calculator florida

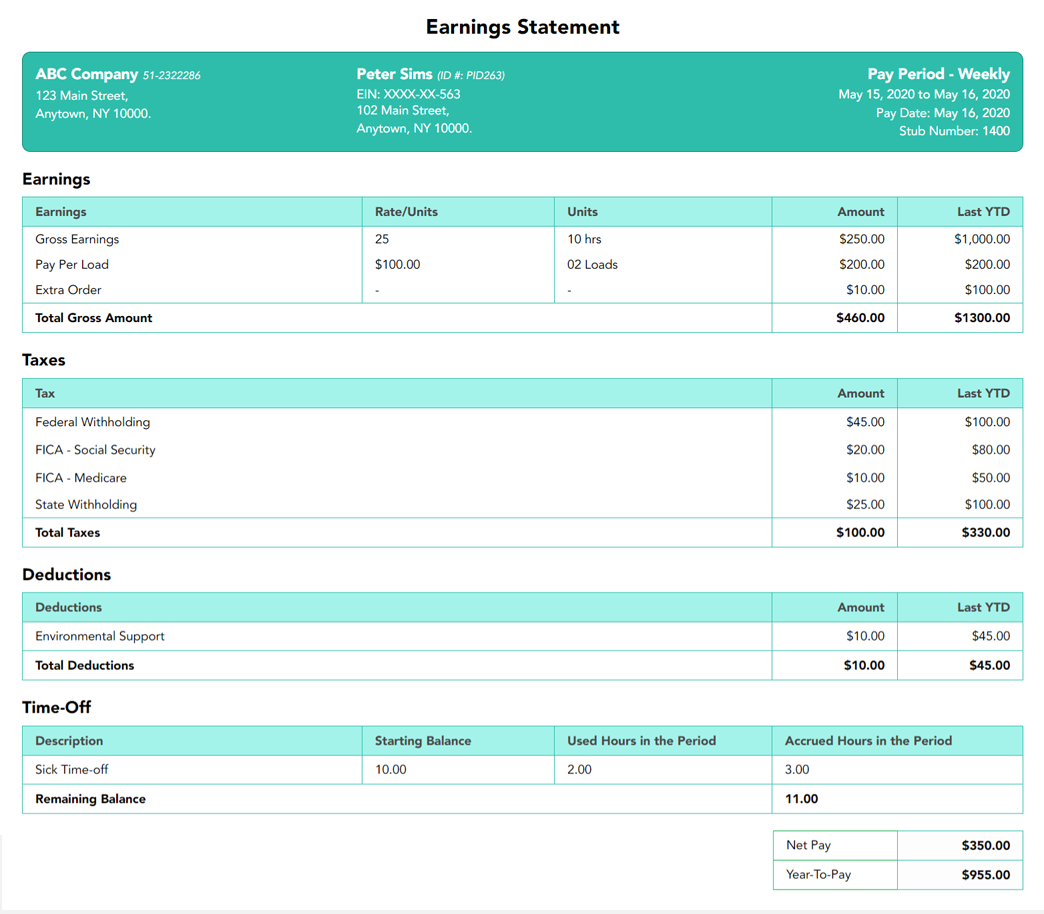

If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Guide to Senior Care Taxes and Payroll.

. FLORIDA LABOR LAWS Minimum Wage. File this application to establish a Reemployment Tax. For example if your nanny.

These taxes are collectively known as FICA and must be withheld from your nannys pay. Call 800 929-9213 for a free no-obligation consultation with a household employment expert. Employers need to withhold around 13-20 of their nannys gross wages to pay for the nanny tax.

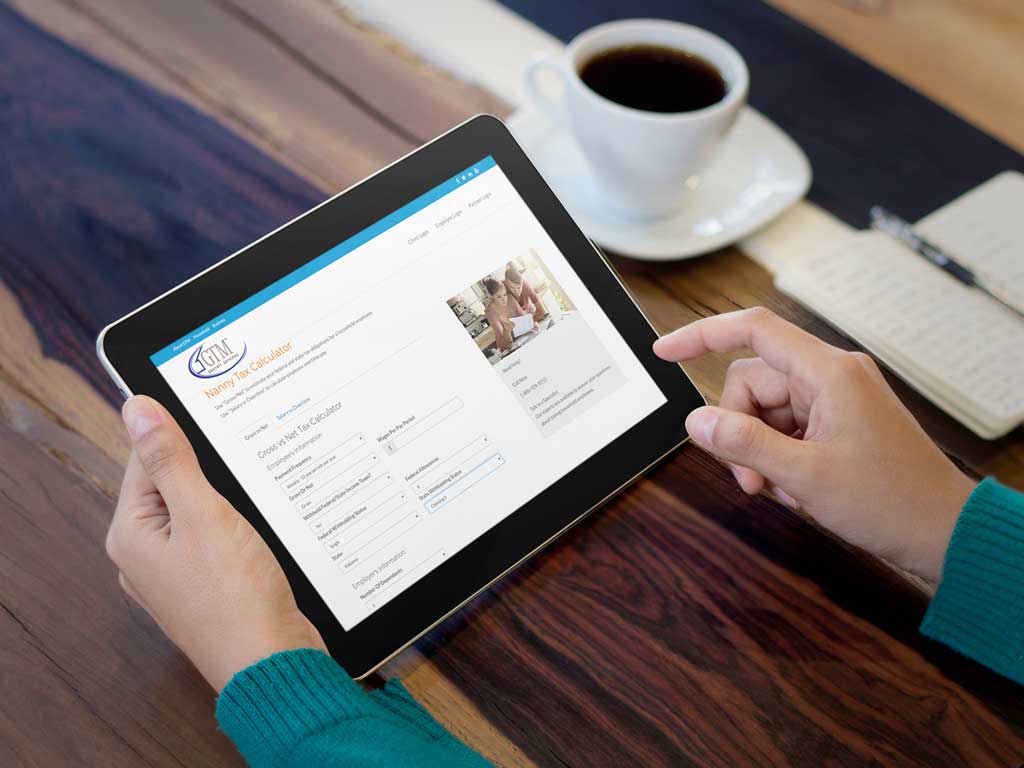

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Your household income location filing status and number of personal exemptions. GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not.

When calculating taxes youll always pay a percentage of your nannys gross wages. If your nanny works 40 hours. Your average tax rate is.

This is their pay before any withholdings or deductions. This calculator will help you understand the total cost of employing a nanny and how much the nanny will take home. Well answer all your questions and show.

Florida Paycheck Calculator - SmartAsset. GTM Can Help with Nanny Taxes in Florida. Social Security taxes will be 62 percent of your nannys gross before taxes wages and Medicare.

Hourly employees in Florida are entitled to a special overtime pay rate of at least 15 times their. Your average tax rate is 165 and your marginal tax rate is 297. If you make 55000 a year living in the region of Florida USA you will be taxed 9076.

Florida defers to the FLSA which requires that all domestics excluding companions be paid at no less than the greater of the state or federal. Nanny tax calculator florida Sunday March 20 2022 Edit. The Nanny Tax Calculator.

As for Social Security and Medicare tax payment 765 will be shouldered by. Learn all the 2022 household employment rules you need to follow. Tax labor and payroll laws vary by state for families hiring nannies and senior caregivers.

Fill in the salary. Easy-to-use nanny tax calculator provides estimate of tax responsibility for a householder employer and tax withholdings for nanny or other domestic worker. What Is Fica What Is Fica On My Paycheck What Is Fica Meaning Surepayroll How To Pay Your Nanny S Taxes Yourself.

How often is it paid. That means that your net pay will be 45925 per year or 3827 per month.

:max_bytes(150000):strip_icc()/Savvy_Nanny_Payroll-ed050500807e408287be6539bc65c0f1.jpg)

The 7 Best Nanny Payroll Services Of 2022

Household Employment Blog Nanny Tax Information Calculate Nanny Payroll Tax

Household Employment Blog Nanny Tax Information Calculate Nanny Payroll Tax

Free Paystub Generator For Self Employed Individuals

![]()

Paycheck Nanny On The App Store

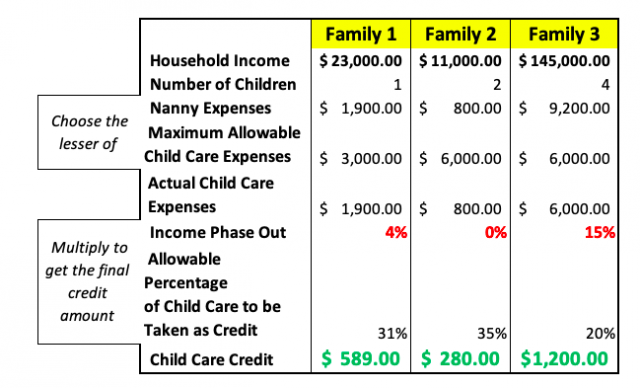

Childcare Tax Benefits Parenting Babysitter Nanny And Infant Care Blog Nannypod

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Nanny Payroll Services For Households Adp

:max_bytes(150000):strip_icc()/Sure_Payroll-3a112ac5844c452c9bcb4cfda0961376.jpg)

The 7 Best Nanny Payroll Services Of 2022

5 Answers You Need When Using A Nanny Tax Calculator

Household Employment Blog Nanny Tax Information Calculate Nanny Payroll Tax

:max_bytes(150000):strip_icc()/GTM_Payroll-f2c3a4f89ead4f2dbb8552456b858a44.jpg)

The 7 Best Nanny Payroll Services Of 2022

Florida Paycheck Calculator Tax Year 2022

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Florida Paycheck Calculator Smartasset

Nanny Taxes Made Easy With Poppins Payroll The Mommy Spot Tampa Bay

:max_bytes(150000):strip_icc()/Nanny_Chexcopy-9fec2333a85e47c0a8219454f3617361.jpg)